inheritance tax wisconsin rates

The Wisconsin state income tax rate is currently 4 on the low end and 765 on the high end. The chancellor has announced that the current nil rate band of 325K will remain frozen until at least 2026 the main residence nil rate band will also be frozen until 2026 also.

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

But rates or very existence of Estate or Inheritance Tax within specific states varies wildly.

. Key findings A federal estate tax ranging from 18 to 40. 56 million West Virginia. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and.

The income tax rate varies over 4 income brackets. All inheritance are exempt in the State of Wisconsin. People who receive less than 112 million as part of an estate can exclude all of it from their taxes.

No estate tax or inheritance tax. Tax rates can change from one year to the next. Maryland is the only state to impose both.

There is no Wisconsin. Twelve states and Washington DC. The property tax rates are among some of the highest in the country at around 2.

Estate planning can bring unexpected challenges so it may make sense to get a professional to help you. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. GENERAL TOPICAL INDEX.

Wisconsin is a moderately tax friendly state. But you dont have to go to Florida to avoid the state estate tax. HMRC are reducing the number of forms needed to be completed.

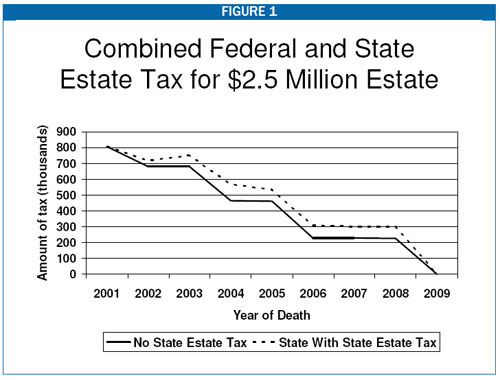

But currently Wisconsin has no inheritance tax. However the top graduated tax rate was reduced to 50 for 2002 with annual decreases of 1 thereafter through 2007. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992.

Brief History of the Inheritance Tax Rates in Wisconsin. Impose estate taxes and six impose inheritance taxes. The top marginal rate was 46 for 2006 and is 45 for 2007 through 2009.

These states have an inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. This number doubles to 224 million for married couples.

Washington DC District of Columbia. Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. There is no Wisconsin gift tax for gifts made on or after January 1.

You can do it right here in Wisconsin. The occasion was the 1898 report of the Wisconsin State Tax Commission Commission 3 a state agency that then consisted of the governor the secretary of state and three. As of 2021 the six states that charge an inheritance tax.

Heres difference between Estate and Inheritance Tax. INHERITANCE AND ESTATE TAX. Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms.

The graduated tax rates ranged from 18 to 55. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. The sales tax rates in Wisconsin rage form 500 to 550.

In more simplistic terms only 2 out of 1000 Estates will owe Federal Estate Tax. Income tax rates average from 4 to 8. State inheritance tax rates range from 1 up to 16.

This book written by Anonim and published by Unknown which was released on 01 March 2022 with total pages 6. Policy Issues Influencing the Inheritance Tax Some of the major public policy issues related to the inheritance tax emerged soon after Sanderson. No estate tax or inheritance tax.

In 2022 the federal estate tax generally applies to. Surviving spouses are always exempt. Inheritance tax rates differ by the state.

Iowa Kentucky Nebraska New Jersey and Pennsylvania have only an inheritance tax that is a tax on what you receive as the beneficiary of an estate. Florida is a well-known state with no estate tax as well. Keep reading for all the most recent estate and inheritance tax rates by state.

Wisconsin does not have a state inheritance or estate tax. The top estate tax rate is 16 percent exemption threshold. There are NO Wisconsin Inheritance Tax.

If the estate is large enough it might be subject to the federal estate tax. Download or Read online Brief History of the Inheritance Tax Rates in Wisconsin full in PDF ePub and kindle. Wisconsin Inheritance Tax Return.

Wisconsin Gift Tax Return. No estate tax or inheritance tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Ad Select Popular Legal Forms Packages of Any Category. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Maine for example levies no tax the first 58 million of an estate and taxes amounts above that at a rate of 8 percent to a maximum 12 percent.

You will also likely have to file some taxes on behalf of the deceased. However like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will. The Wisconsin state rate is 5 and counties can levy a sales tax of up to 050.

As provided under EGTRAA all of the rates except those at the top remain the same as they were under prior law. Anyone who gets more than that has to pay a tax rate of up to 40 percent on the excess. Wisconsin tax structure.

The Federal estate tax only affects02 of Estates. Wisconsin also has a sales tax between 5 to 6 and counties can leverage an additional 1 to 2 on top of that. This is consistent with national averages.

Estate taxes are based on value of the deceaseds property only apply if estate exceeds exemption and are paid before money is distributed to heirs. Wisconsin Inheritance and Gift Tax. More on Wisconsin taxes can be found in the tabbed.

However if you are inheriting property from another state that state may have an estate tax that applies. Wisconsin does not levy an inheritance tax or an estate tax. In March 2021 the government announced changes in Inheritance Tax that became effective in January 2022.

All Major Categories Covered.

Wisconsin Estate Tax Everything You Need To Know Smartasset

2020 Property Tax Statements Online For Much Of Washington County Washington County Insider

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Property Tax Comparison By State For Cross State Businesses

Wisconsin Estate Tax Everything You Need To Know Smartasset

Florida Realtors Florida Real Estate California Real Estate Florida

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The Estate Tax And How Does It Work Wisconsin Attorneys Ruder Ware

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Compare Greater Cleveland Akron Property Tax Rates And Learn Why They Have Changed This Year That S Rich Cleveland Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Wisconsin Estate Tax Everything You Need To Know Smartasset

100 Best Places To Retire The Sunbelt Rules Once Again In 2013 Best Places To Retire Retirement Community Best Places To Live